State-of-the-art

monitoring of your

financial services

IT infrastructure

- Central overview of your entire financial IT environment, also of distributed networks

- Comprehensive insights into compliance with governmental regulations and standards

- Reliable security, application, and performance monitoring of financial technology & services

5 reasons why experts monitor financial services with PRTG

Financial IT encompasses the infrastructures, systems, processes, and applications required by financial services institutions. The past few decades have brought on massive changes for the financial services sector and its IT systems. These changes make it crucial to always keep an eye on financial services IT.

- Monitor banking processes, websites, mobile banking devices, and more with a single tool

- Collect monitoring data from distributed locations and manage them in a central interface

- Integrate hard- and software from popular vendors out-of-the-box via standard technologies

- Make sure that sensitive data as well as the entire network is protected against intrusions

- Ensure data-based compliance with governmental regulations and audit frameworks

These challenges make IT monitoring in the finance sector essential

E-finance has brought about increased convenience, accessibility, and efficiency in financial services. This makes it easier for individuals and businesses to manage their money and access a wide range of financial products and services. However, it also comes with its own set of challenges.

Rapid digital transformation

The digitalization of financial services and systems has brought on massive changes in the financial industry as Fintech is on the rise:

- Retail banks have moved to online banking and using mobile banking services has become the norm

- Transactions such as payment processing or credit card processing are done electronically

- ATM terminals and cashless payment systems are connected to the internet

- Most financial organizations have call centers to support customers, and call center agents need remote access to customer records

This change has also brought a lot of challenges in terms of how to manage these heterogeneous infrastructures and make them more secure at the same time.

Ensuring IT infrastructure security

For FSI businesses, security remains the top priority and the top challenge. With the move online, there are now more ways for systems to be compromised:

- Hacked bank accounts and accounting systems, often through phishing emails or fake call center calls

- Manipulated ATMs and large-scale credit card fraud by reading credit card details without physical contact

- Network attacks through viruses and other malware that can bring entire IT systems down

IT professionals in these environments need to ensure that all internal as well as external-facing networks utilize the latest in security technology. And of course, physical security is still important and includes aspects such as facility access control and CCTV cameras.

No centralized system overview

For a bank, stock trader, or insurance company to get a meaningful overview of their financial IT system can be challenging as well:

- Legacy systems interface with more modern systems and applications, and cloud services or virtual environments need to be integrated as well

- Networks include hardware from many different vendors and use many different protocols for electronic communication

- Many financial institutions operate across multiple locations, which means that IT networks are distributed and often separately managed.

As financial IT infrastructures are becoming more complex, IT professionals need to find a tool that brings the various systems, devices, technologies, and locations together in a unified overview.

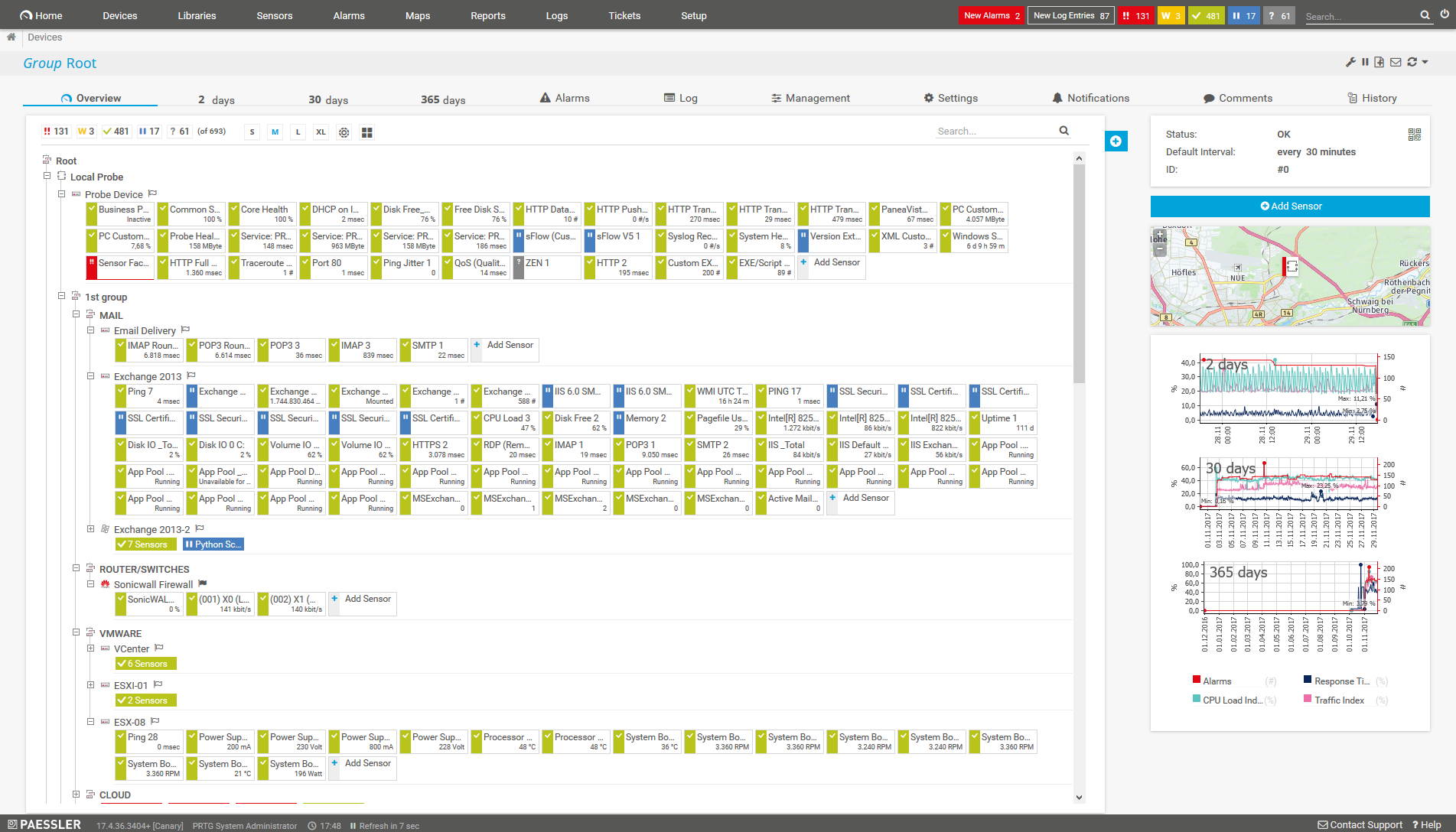

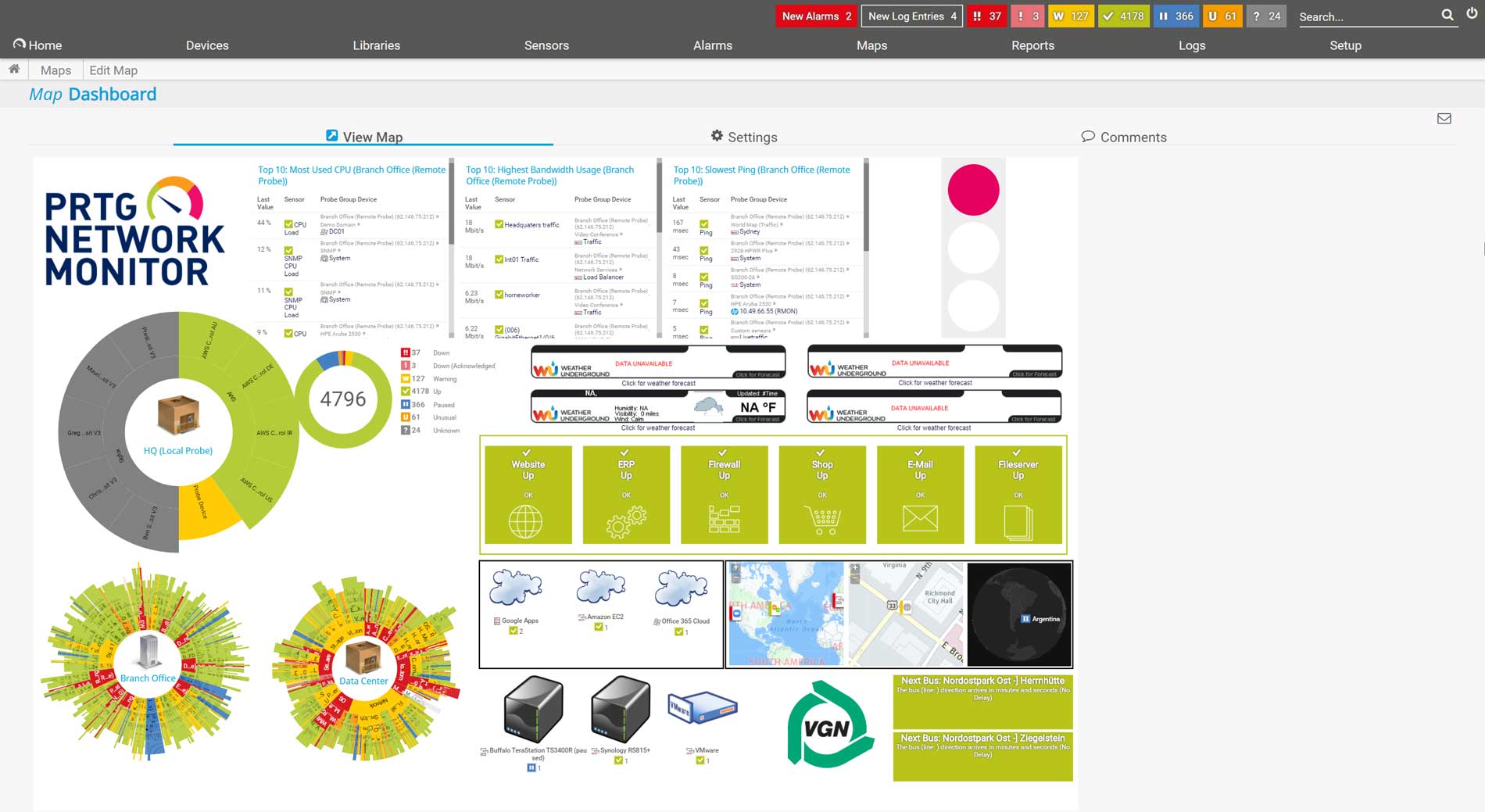

What financial IT monitoring looks like in PRTG

Diagnose issues with your e-finance infrastructure by continuously monitoring your hardware, applications, bandwidth, availability, and more. Show monitoring data in real time and visualize it in graphic maps & dashboards to identify problems more easily. Gain the visibility you need to troubleshoot issues before they become critical.

Start monitoring your financial services IT with PRTG and see how it will make your job easier as well as your network and the transfer of sensitive data more secure.

Why PRTG is the financial services monitoring tool of your choice

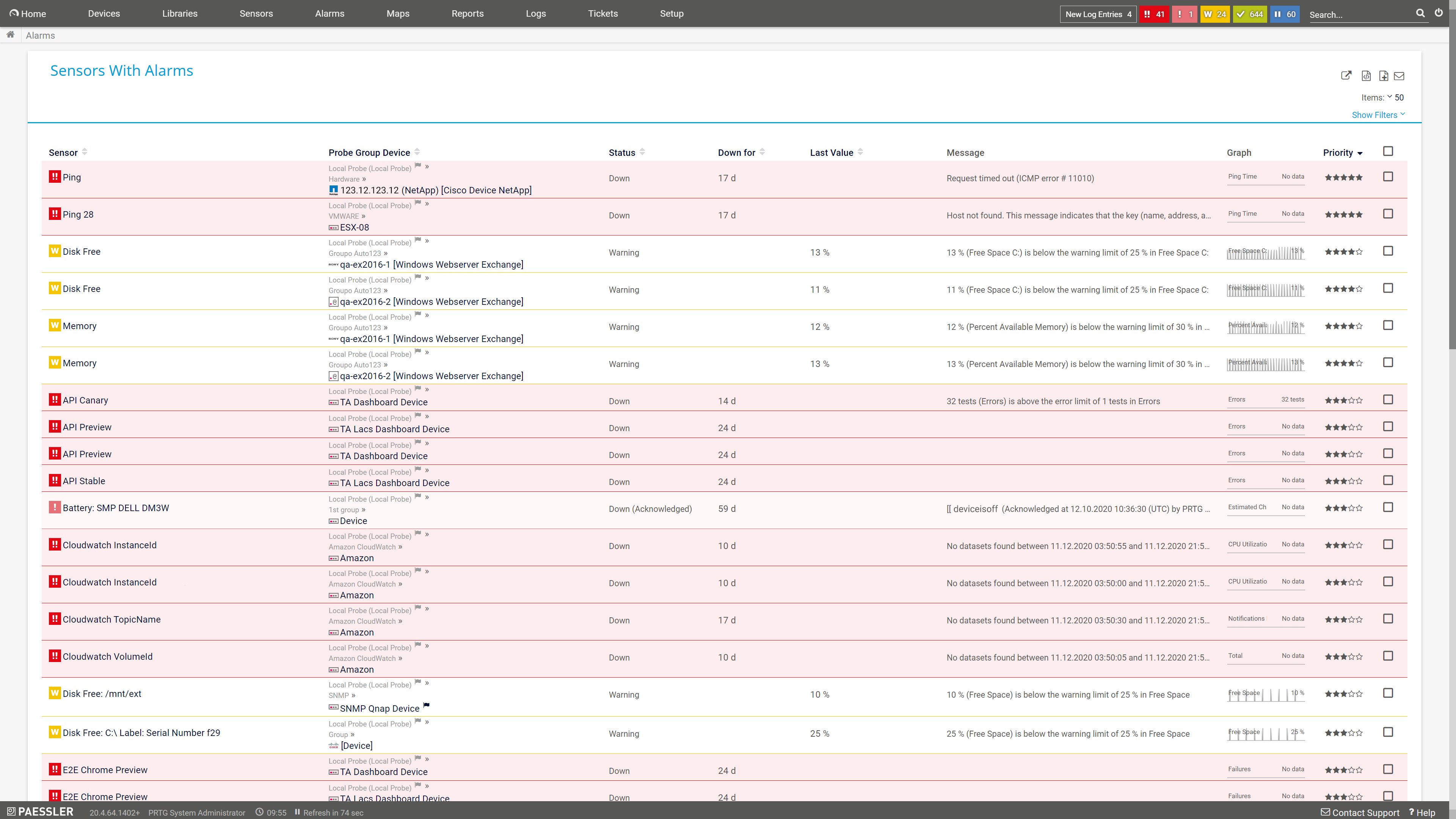

Ensure intrusion detection & network security

- Monitor security tools like virus scanners and firewalls to make sure they do their job

- Detect unusual activities that might be signs for potential network security breaches

- Keep an eye on physical security devices like CCTV cameras or access control systems

Centrally view distributed networks at remote locations

- Monitor multiple locations including smaller ATM terminal sites at no extra cost

- Collect monitoring data locally and send it to a central server secured via SSL/TLS

- Flexibly scale your monitoring as your company and IT infrastructure grows

Integrate heterogeneous systems and devices

- Keep an eye on hard- & software from popular manufacturers without vendor lock-in

- Monitor your systems via all standard IT protocols out of the box or via the PRTG API

- Use preconfigured device templates and PRTG sensors for easier setup & integration

Guarantee user satisfaction & regulatory compliance

- Ensure high-speed connectivity at peak performance to avoid user frustration

- Strive for 99.999% uptime of bank & stock trading systems to prevent lost revenue

- Use monitoring data to prove compliance with governmental regulations

Receive customizable alerts & notifications

- Define warning and error thresholds to be alerted even before a more serious issue occurs

- Set notification triggers with escalation levels to inform the right people at the right time

- Choose from notification methods such as SMS, email, push notification, and more

Start monitoring your financial services IT with PRTG and see how it will make your job easier as well as your network and the transfer of sensitive data more secure.

“Excellent tool for detailed monitoring. Alarms and notifications work greatly. Equipment addition is straight forward and server initial setup is very easy. ...feel safe to purchase it if you intend to monitor a large networking landscape.”

Infrastructure and Operations Engineer in the Communications Industry, firm size 10B - 30B USD

Success stories from our customers

Companies around the world trust PRTG Network Monitor when it comes to ensuring that their IT systems run smoothly.

Paessler PRTG pays off for Australia’s Hume Bank

Hume Bank is a financial institution offering north-eastern Victoria and southern New South Wales a local banking alternative that isn’t owned by profit driven shareholders. With PRTG, Hume Bank gains greater insight into the organization's IT networks to help maintain a highly available platform for the business and its customers, crucial for a financial organization built on trust.

Financial assets at Rüsselsheimer Volksbank are secure with Paessler PRTG

At Rüsselsheimer Volksbank eG, 158 employees manage investments and develop financial & retirements plans for their customers. Without a reliable IT infrastructure, the bank cannot provide these services. PRTG helps prevent failures in the IT infrastructure and also automates many of the bank’s troubleshooting tasks, such as the rebooting of important services.

Banca Profilo relies on monitoring with Paessler PRTG to safeguard its critical infrastructure

Active in the market since 1995, Banca Profilo is an institution that specializes in private and investment banking as well as asset management. Banca Profilo manages its IT infrastructure primarily in-house and uses PRTG to monitor its on-premises data center as well as six branches and an extranet network with site-to-site connections to outsourcers of several critical services.

Create innovative solutions with Paessler’s partners

Partnering with innovative vendors, Paessler unleashes synergies to create

new and additional benefits for joined customers.

Lansweeper

Asset visibility is a big problem for many IT teams. Not having an accurate inventory of tech assets is inefficient, costly and a potential security risk.

Monitoring financial services IT: FAQ

1. What is e-finance?

E-finance, short for electronic finance, refers to the use of electronic technology and digital platforms to conduct various financial transactions and manage financial activities. It encompasses a wide range of financial services and activities that are carried out electronically, often over the internet.

E-finance has become increasingly important in modern finance due to advancements in technology and the growing digitalization of the financial industry.

2. What are examples for e-finance and financial technologies?

- Online banking: Online banking services that allow individuals and businesses to check account balances, transfer funds, pay bills, and perform other banking transactions through secure websites or mobile apps.

- Electronic payment systems: Various electronic payment methods such as credit card payments, mobile wallets, peer-to-peer (P2P) payment platforms, and digital currencies like Bitcoin and cryptocurrencies.

- Online investment: Many people use e-finance platforms to buy and sell stocks, bonds, mutual funds, and other investment instruments online through brokerage accounts.

- Online insurance services: Insurance companies offer e-finance options for purchasing and managing insurance policies, submitting claims, and accessing policy information.

- Financial planning and budgeting apps: There are numerous e-finance tools and applications that help individuals and households manage their finances, track expenses, create budgets, and plan for financial goals.

- Digital financial advice: Some e-finance platforms offer robo-advisors, which are automated investment advisory services that use algorithms to provide investment recommendations based on individual financial goals and risk tolerance.

- Online trading: E-finance includes online trading of various financial instruments, including stocks, commodities, and foreign exchange (forex), often facilitated by electronic trading platforms.

3. What is financial services IT monitoring?

Financial services IT monitoring refers to the process of closely observing and managing the IT infrastructure and systems within the financial services industry. This monitoring is essential to ensure the reliability, security, and performance of IT systems that are critical to financial institutions' daily operations.

Financial services IT monitoring involves the use of specialized tools, techniques, and practices to keep IT systems running smoothly and securely.

4. Which features should solutions for monitoring financial services IT include?

- Infrastructure monitoring: This aspect involves monitoring the physical and virtual components of an IT infrastructure, including servers, databases, networking equipment, and storage devices. It ensures that hardware is functioning correctly and efficiently.

- Application monitoring: Financial institutions rely on various software applications for core banking, trading, risk management, and customer service. Application monitoring involves tracking the performance and availability of these applications to prevent downtime and optimize user experiences.

- Security monitoring: Security is a paramount concern in the financial sector due to the sensitive nature of financial data. IT monitoring includes security measures such as intrusion detection, threat analysis, and continuous monitoring of network traffic to identify and respond to potential security threats or breaches.

- Compliance monitoring: Financial institutions must adhere to strict regulatory requirements and compliance standards. IT monitoring helps ensure that IT systems comply with these regulations and that necessary audits and reporting are conducted as required.

- Performance monitoring: Monitoring the performance of IT systems is crucial to prevent bottlenecks, outages, or slowdowns that could impact the delivery of financial services. It involves tracking metrics like response times, transaction throughput, and resource utilization.

- Event and log monitoring: Financial services IT monitoring tools collect and analyze logs and events generated by various systems and applications. This helps in identifying anomalies, errors, or patterns that may indicate issues or potential threats.

- Capacity planning: Financial institutions need to plan for future IT infrastructure needs. Capacity planning involves analyzing historical data and trends to determine when and how to scale up IT resources to meet growing demand.

- Alerting and notifications: Monitoring tools are configured to send alerts and notifications when predefined thresholds are breached or when specific events occur. This allows IT teams to respond quickly to issues and minimize downtime.

- Business continuity and disaster recovery: Monitoring also plays a role in ensuring business continuity. IT monitoring can help detect issues that may affect business operations and trigger disaster recovery plans when necessary.

5. What is a sensor in PRTG?

In PRTG, “sensors” are the basic monitoring elements. One sensor usually monitors one measured value in your network, for example the traffic of a switch port, the CPU load of a server, or the free space on a disk drive.

On average, you need about 5-10 sensors per device or one sensor per switch port.

Start monitoring your financial services IT with PRTG and see how it will make your job easier as well as your network and the transfer of sensitive data more secure.

Combining the broad monitoring feature set of PRTG with IP Fabric’s automated network assurance creates a new level of network visibility and reliability.